With the hurricane Sandy hitting American East Coast, a lot of companies have seen their activities, either disrupted or more severely impacted with notably flooding and power outages.

With the hurricane Sandy hitting American East Coast, a lot of companies have seen their activities, either disrupted or more severely impacted with notably flooding and power outages.

What can we learn from this ? What does it mean in terms of Risk Management, and especially Supply Chain risk management ?

In the last 4 years, several very significant external events have occurred, most of them completely unpredictable while terrifically challenging for most companies: financial crisis followed by a severe economical downturn, climatic diasters, political turmoil (Arab spring, Iran..), currency exchange rate fluctuations, Euro crisis…

Let’s look into more details at how companies can being affected by such events. And le’ts understand why managing Supply Chain risks is of paramount importance.

- In March 2000, Ericson, at the time the largest supplier of mobile telecom systems, was hit by the consequences of a minor fire at one of its main supplier facility located in New Mexico. While the fire was contained in less than 10 minutes, it happened in a clean room and the consequences of smoke and sprinkled water caused the interruption of the production for 3 weeks. Six months later, the production was still half of what it was before the fire and it severely impacted the production of mobile phones. As Ericson was relying on this unique facility to make a chip that was used in its mobile phones, it encountered a major impact on its sales (losses were reported of $ 200 millions).

- More recently, in October 2011, very heavy rains submerged large areas of Thailand and the consecutive flooding of several industrial parks largely hit well-known multinational high-tech companies.

- Nikon saw its main plant in Thailand becoming swamped with water. As this plant was producing about 90% of the maker’s digital single-lens reflex camera, Nikon eventually had to swallow a one-off loss of $140 millions.

- Since approximately 25% of the world’s supply of disk drives is manufactured in Thailand, every company that planned to buy disk-drives or machines that use disk drives in the first half of 2012 has been affected.

So, how to manage such risks ?

Risk identification

The first phase is to identify the main risks that can potentially impact the supply chain. The most commonly used methodology is to organize a cross-functional brainstorming session with experts from different fields: sourcing, operations management, logistics, etc…

The outcome of the exercise is a list of potential risks, external and intrinsic.

External risks

They can be defined as the ones not under the direct control of the company and which are by nature mostly unpredictable. Let’s review the major categories:

-

Currency exchange rate fluctuations

Currency fluctuations are affecting the whole P&L: Revenue, Purchasing costs, Operating expenses, etc.. which in turn affect the profitability of the company (EBIT..). While currency fluctuations in itself is not new, we’ve seen the phenomenon affecting also so-called strong currencies such as the US$ or the Euro. Looking at the Euro/USD parity, 1 EUR was worth 1.58 US$ in July 2008 but only 1.20 US$ in June 2010 ! and 1 EUR was worth 1.67 CHF in Oct. 2007 but went down to almost 1 CHF in August 2011.

While currency fluctuations have far more consequences that just Supply Chain, it is worth evaluating the impact of Supply Chain costs (which can account between 5% to 30% of sales).

In the last 10+years, a number of major climatic disasters have affected the world economy. Some recent examples, in addition to Sandy:

- Thailand: Flooding (October 2011)

- Japan: Tsunami and subsequent nuclear disaster (March 2011)

- USA: Snowstorm (Jan./Feb. 2011)

- Island: Eyjafjöll Volcano eruption (April 2010)

- USA: Katrina Hurricane (2005)

- India/Thailand/Indonesia.. : ocean tsunami (Dec. 2004)

- Japan: Kobe Osaka earthquake (Jan. 1995)

Climatic disasters often lead to:

- Interruption of operations

- Travel restrictions

- Important damages on assets

- Inability to source goods or distribute products

- Important damages on assets

- Product Losses

- Lost sales due to product shortages

-

Industrial accidents

We all remember some of the most critical industrial disasters that have ever happened:

- France: Toulouse AZF plant blow-out (2001),

- India: Bhopal gas leakage (1984),

- Italy: Seveso explosion (1976).

While major industrial disasters such as the ones below are hopefully rare, there are a significant number of smaller events, notably fires, whose consequences include a complete or partial interruption of operations and subsequent supply of goods. (see Ericson example above)

-

Crude oil price variation

The almost continued oil price increase over the last 20 years has largely contributed to the transport cost increase year after year.These increases are now directly paid by companies through the fuel surcharges mechanisms put in place by airlines and seafreight transport companies.Crude oil price also affect the price of many chemicals and commodities that are directly or indirectly derived from petro-chemical industry.

-

Customs and Trade agreements

Customs tariffs are a very complex topic which requires in-depth expertise. For many companies, performing import/export operations in countries like Russia, India or Indonesia can be actually very challenging. Failing to fully comply with customs requirements has usually non dramatic consequences – it just takes time to get additional paperwork (documentation, certificates etc.), but when Customs authorities start to suspect that a company is not 100% clean, then the real problems start: systematic controls are being done which can end up in very subsequent financial penalties to be paid.

Due to the stalling of global and multilateral discussions held under the WTO (World Trade Organization), bilateral and regional agreements have taken precedence and proliferated as countries have recognized the importance of such agreements to boost trade. The consequence for companies is that they have to deal with multiple sets of rules and administrative requirements.

Very recently Argentina has decided to impose import restrictions in order to reduce its trade balance deficit and protect its domestic economy. Some companies, including major multinationals have been severely hit by the consequences of these new regulations.

-

Political instability, embargo situations

Political instability can take various forms, but at the end of the day, it makes it more difficult and more risky for companies to operate in certain countries. Recent events such as :

- The uprisings in Arabic countries

- The embargo against Iran

have direct impact on companies operating or making business with these countries. More generally, companies operating in politically unstable zones are facing risks of re-nationalization, borders closing, etc.

-

Social conflicts

With the economic downturn, Europe is facing many social conflicts, notably with the closing of industrial sites. But other probably less expected issues arise in other parts of the world with potentially high impact on the whole economy. Let’s take a very recent example:

Early September this year, the labor negotiations between the International Longshoreman’s Association (ILA) and the United States Maritime Alliance (USMX) were are at an impasse. Without an agreement, everyone was getting prepared for a labor strike along the U.S. East Coast and Gulf Coast ports. At that time, several scenarios were evaluated but if most stakeholders believed a potential strike would last 1 or 2 days max. everyone agreed that this would have major economic consequences:

A one day stoppage at all East Coast Ports would result in cargo delays of approximately 10 days through the affected ports and a 48 hour strike a potential a 20 days delay in cargo movement.

Eventually the strike didn’t happen but this has highlighted the high level of vulnerability of many companies.

-

Pandemics and Epidemics

We all have in mind the SARS in China in 2003. More generally, pandemics and epidemics lead to travel restrictions and quarantine measures.

-

Legislation and legal requirements

Change in regulations can directly affect companies’ P&L. As an example, for the Chemical Industry, the recent enforcement of the Globally Harmonized System of Classification and Labeling of Chemicals (GHS) has led to a huge re-classification of products under the Dangerous Goods category. Products becoming classified as Dangerous Goods resulting in additional transports costs, up to 30%.

Following the September 11’ terrorist attack, USA and many other countries have reinforced security measures regarding the transportation of goods, especially for air transportation. Security surcharges are now being paid by all companies to their freight forwards to compensate for the additional security measures being implemented.

Intrinsic risks

They can be defined as the risks inherent to a company’s organization, its processes and how it operates. Below a non-exhaustive list of criteria that can help to evaluate the level of vulnerability. The left column lists high-risk configurations as opposed to the low risk configuration examples listed in the right column.

-

Sourcing

|

High risk configuration |

Low risk configuration |

|

|

Aggressive suppliers’ portfolio rationalization and pure cost reduction strategies tend to reduce the number of sourcing options as some suppliers exit the market or refocus on more profitable activities.

-

Social responsibility

High risk configuration

Low risk configuration

- Multi-level subcontracting operations or sourcing from countries known for their laxity regarding children work, environmental impact, etc.

- Limited operations in risky countries [1]

- Regular audits of suppliers and third-party companies conducted by external control and certification entities (SGS, Veritas..)

With more than 3’000 stores across the world, Gap, has become one of the most successful and iconic brands in fashion. Under several occasions, Gap discovered it was actually working with suppliers using child labor to produce clothes.

Despite GAP had a Vendor Code of Conduct, it had to terminate contracts in 2006 with 23 factories due to code violations. In 2007, Gap found out that clothing intended for the Christmas market had been improperly subcontracted to a sweatshop using child labor. Not only Gap brand image has been seriously deteriorated but it also had to withdraw all the clothes from its stores.

-

Manufacturing network

|

High risk configuration |

Low risk configuration |

|

|

-

Workforce

|

High risk configuration |

Low risk configuration |

|

|

- Geographical footprint

|

High risk configuration |

Low risk configuration |

|

|

Looking at Asia, Vietnam now has Asia’s highest inflation rate, close to 20% for the second time in four years.

Risk evaluation in practice

Each risk is then assessed against 2 criteria:

- Probability of occurrence

- Impact

Final risk level is by evaluated by combining probability and impact:

Risk Level = Probability x Impact.

When evaluating the probability of occurrence of climatic disasters, the geographic dimension must be considered:

- Earthquakes are very frequent in some parts of the world like Japan or Indonesia, but very low in the US if we exclude the zone around San Andreas in California.

- Winter snow storms in North East part of the USA have become quite frequent, so the probability is somewhere between medium and high.

Risk mitigation strategies

Classical risk mitigation approach is based upon 4 complimentary approaches:

- Risk Avoidance

- Risk Reduction

- Risk Transfer

- Risk Acceptance

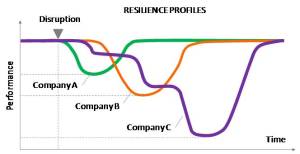

Resilience

Resilience is defined as the ability to recover from or adjust easily to misfortune or change (Webster dictionary).

As far as risk management is concerned, resilience takes into account not only the impact but the time it takes to recover from an incident.

The propagation of a disruption always goes downstream, an incident occurring in the plant of a supplier of a supplier can potentially affect the whole value chain up to the retail point.

The Reaction Time measures the time between the happening of the disruption and its effective impact on the company (for example a product shortage..)

Just-in-time such as the ones in the automotive industry, reaction time can be very short, from a couple of hours to a couple of days, as the whole supply chain is very tight with no buffer stock whatsoever.

The propagation of a disruption always goes downstream, an incident occurring in the plant of a supplier of a supplier can potentially affect the whole value chain up to the retail point.

Company A is the first to be hit by the disruption but the impact is moderate and it rapidly recovers its initial state

Company A is the first to be hit by the disruption but the impact is moderate and it rapidly recovers its initial state

The disruption takes more time to impact Company B but the impact turns out to be bigger and it takes longer time to recover.

Initial impact on Company C is very limited but instead of moving rapidly back to its initial state, Company C is hit by a succession of disruptions waves whose effects are amplified each time. This is the so-called domino effect.

Conclusion

We are living in an inter-connected and uncertain world. It’s only a question of time before any major event somewhere in the world starts to affect an entire industry or even the whole economy.

Whereas we can take the pulse of the world almost in real time, It’s somewhat paradoxical to acknowledge that we are less in control.

Risk management approaches are key to understand the level of intrinsic vulnerability of an organization and limit as much as possible the level of risk.

However, the best risk management strategy will do very little when facing major external disasters.

In my opinion, once a reasonable and acceptable level of risk has been achieved, most of the effort should be to build more flexibility and become more resilient.

Don’t try to avoid issues at all costs, just be better prepared than the others to deal with them when they occur.

Pierre Chorand

[1] The area of Delhi in India is being recognized by the United Nations as the world’s capital for child labor. According to one estimate, more than 20 per cent of India’s economy is dependent on children, the equivalent of 55 million youngsters under 14.